PremFina: 4x Support Efficiency & 100% SLA with AI Automation

PremFina, a leading UK premium finance provider and member of the global InsurTech Top 100, experienced rapid growth that significantly increased the complexity of its customer service operations. As enquiry volumes rose across email, web forms and text, existing manual processes became difficult to scale. This created risks around SLA compliance, operational costs, customer satisfaction and regulatory adherence. With average handling times reaching 7–10 minutes and some email enquiries taking up to 23 hours to resolve, PremFina needed a scalable, compliant automation solution capable of supporting its expanding customer base.

As PremFina’s customer base expanded rapidly, enquiry volumes across email, web forms and text grew at a pace that began to overwhelm the support team. Manual handling of routine, low-complexity requests was no longer sustainable, driving up operational costs and reducing overall efficiency. Agents were increasingly burdened by repetitive tasks, which created fatigue and affected team morale, while longer response times put customer satisfaction at risk. In a highly regulated financial environment, these bottlenecks also raised concerns around SLA compliance and operational governance. To continue scaling without increasing headcount, PremFina needed an innovative, reliable and fully auditable automation solution capable of managing large enquiry volumes while preserving the quality and consistency of the customer experience.

Transforming PremFina’s Contact Centre with AI Orchestration

PremFina is a UK-based leader in premium finance and a recognised member of the global InsurTech Top 100. Its rapid growth and strong focus on innovation created new challenges for scaling customer service while maintaining a high-quality experience. As customer numbers increased tenfold, enquiry volumes across channels such as email and web forms grew sharply, covering categories like payment schedules, policy queries, bank details, cancellations, transaction queries, and renewals.

Before introducing Aileen in early 2025, the contact centre handled all these enquiries manually. Average handling times were between 7 and 10 minutes, and email or website requests could take up to 23 hours to resolve. This situation risked overloading the support team, driving up operational costs, impacting SLA compliance, and putting customer satisfaction and regulatory compliance at risk.

PremFina needed a way to automate repetitive, low-sensitivity enquiries, improve agent productivity, and scale efficiently without a proportional increase in headcount, while still guaranteeing a compliant and consistent customer experience.

Developed by Ardanis, Aileen is a managed AI orchestration platform for process automation that combines powerful automation, intelligent routing, and sentiment-aware escalation. For PremFina, Aileen was implemented to autonomously execute multi-step workflows, triage and resolve routine enquiries, and escalate complex or sensitive cases to human agents, all while ensuring auditability and regulatory compliance.

Aileen now processes more than 50% of all email and website enquiries — the equivalent workload of three to four full-time agents. Automated tickets are resolved in under 30 seconds, compared with up to 23 hours under the previous manual process, unlocking 100% SLA adherence for these cases and freeing agents to focus on high-value interactions.

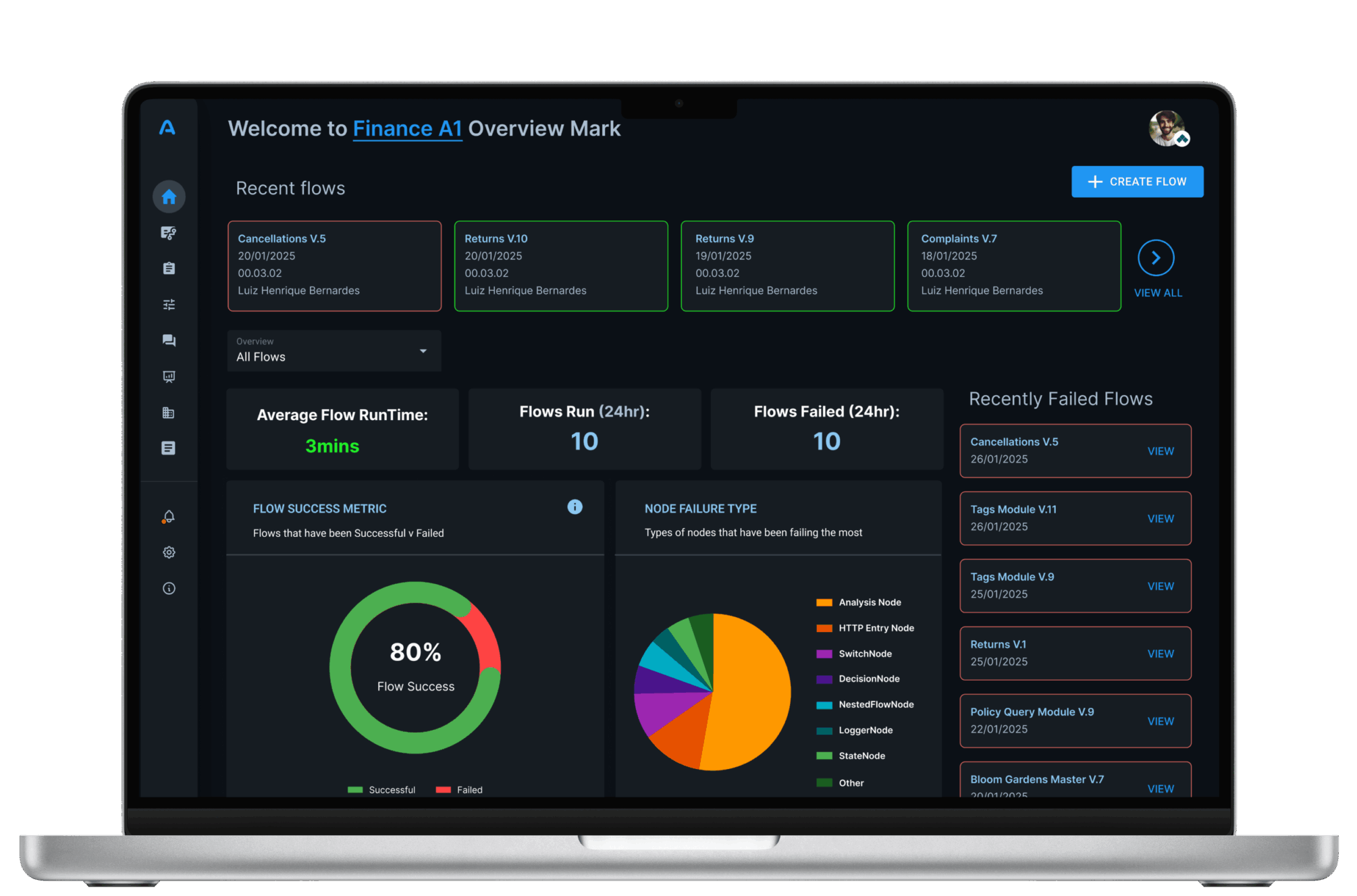

Beyond automation, Aileen supports agents in real time with AI-driven guidance for complex cases, integrates seamlessly with PremFina’s existing systems to trigger updates and actions, and provides granular visibility into performance, SLAs, and automation coverage through real-time dashboards.

Technologies Used

Managed AI orchestration platform (Aileen), NLP and intent classification, LoRA-based continuous learning, sentiment detection, real-time KPI dashboards for SLA and automation coverage, node-based modular workflow architecture, human-in-the-loop validation, API integrations with core PremFina systems and contact centre platforms.

Key Outcomes

- 100% SLA compliance for automated tickets: Enquiries handled by Aileen are now resolved in under 30 seconds, compared to up to 23 hours under manual processing, which previously achieved 89% SLA adherence.

- 50% automation of email and web enquiries: Aileen autonomously resolves more than half of all email and website requests, representing 37% of total customer queries across top categories such as policy queries, bank details, and payment schedules.

- 3–4x agent efficiency: The automated workload now handled by Aileen is equivalent to three to four full-time agents, allowing the human team to focus on complex, high-value cases instead of repetitive tasks.

- Improved employee and customer experience: Staff morale increased from 80% to 88%, while customer satisfaction remained high, supported by a 4.7 TrustPilot rating and a 14% reduction in customer complaints.

- Future-ready, compliant automation model: With a node-based modular architecture, real-time dashboards, and human-in-the-loop controls, PremFina has established a scalable and auditable reference model for regulated AI adoption in financial services.

- Roadmap for expansion: Aileen is set to extend into chat and self-service portals, predictive support, and deeper back-office automation, further enhancing operational resilience and customer experience.

We are ready for new challenges